How can companies respond to changing consumer behaviour in times of crisis?

Published on 03 04 2020Article Dr. Lisette Kruizinga – de Vries – Senior Methodologist

Dr Lisette Kruizinga is a senior methodologist at DVJ. Lisette obtained her PhD in marketing research at the University of Groningen and then worked in the academic world for several years. During her promotion she studied the drivers of loyalty during periods when consumer confidence is low, which is the case during periods of crisis.

Deserted streets & crashed stock markets

The past few weeks and the next few weeks will be dominated by Covid-19, or the corona crisis. The drastic measures different countries in Europe have taken to prevent further spread of the virus have led to uncertainty and anxiety. The hospitals are recruiting everyone they can find. People are working from home when they can. Cafés and restaurants, several shops, schools and nurseries are closed. The usually very crowded streets are now deserted.

This great uncertainty and the fact that consumers simply have less to spend, has caused the stock markets to crash. It has also become evident that the advertising market is collapsing completely, and many people will lose their job (Waaijers, 2020; Wouters, 2020). What other consequences we will face on the long term, is still left to speculate, but it’s certain they will be big. At the end of March, the CPB in the Netherlands provided four different scenarios on the consequences this economic crisis will have on the economic growth, unemployment and the government’s balance, based on academic insights (CPB, 2020). Scenario 1 is the best-case scenario, scenario 4 the worst (Figures below). In the first scenario, only the sectors which are currently closed such as restaurants, cafés and hairdressers, will be impacted. The Netherlands will briefly enter a recession, but will also start to recover quickly. In the fourth full-blown disaster scenario, measures will continue for about 12 months, which will have disastrous consequences for the economy.

Scenario 1

Scenario 4

Within a large-scale study by DVJ into the consequences of this crisis, we presented these four CPB scenarios and asked respondents which scenario they deem most likely. Scenario 2 was chosen the most (32%). This scenario includes approximately 6 months of corona measures. As a result, the sectors that are now obliged to be closed will receive the biggest blow, but other industries will also feel the consequences. The government will provide more aid, which will cause the budget balance to become negative.

Scenario 2

This is not the first crisis our country finds itself in, and it will definitely not be the last. Stephan Knaeble has recently written on what we know from other crises from a practice standpoint. We have summarised to what extent brands are affected by a crisis. In this article we will provide a scientific review of consumer behaviour during a crisis or recession and how companies can best respond from a scientific perspective.

CONSUMER BEHAVIOUR IS CHANGING: HOARDING, DELAYING OTHER PURCHASES AND PRICE SENSITIVITY

The coronavirus will probably lead to a strong drop in consumer trust. The most recent figures from the Dutch CBS aren’t in yet, but during a recession, consumer trust is low. The consumer trust is a psychological measure which shows the current and future trust of consumers in the economy and their own financial situation. Consumer trust has a negative relation to purchasing behaviour. Apart from consumer trust, the current situation is unique, because many restaurants and stores are closed. The supermarkets seem to profit, but this might be short-lived. Some purchases we may not be able to do in-store, can be done online, but not all. So, overall, uncertainty and diminished consumer trust means consumers will spend less. Consumers will also pay more attention to prices of products during recessions.

From the earlier mentioned DVJ study, we have also seen that not all categories are affected to the same extent. The behaviour of people is changing, which opens up new possibilities.

A lot of companies see REVENUE drop and cut costs on marketing expenses

Because of this, more companies are seeing their revenue drop. As a result, they will start cutting costs on for example marketing expenses, by broadcasting less commercials and campaigns, because they are often seen as short-term resources. But is this wise to do? How can a company best deal with this extreme drop in demand and the increased price sensitivity of consumers?

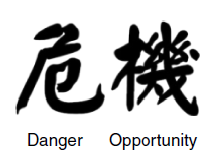

”In the Chinese language, the word ”crisis” is composed of two characters, one representing danger and the other, opportunity.” – J.F. Kennedy (in his speeches in 1959 and 1960)

LOWER PRICES, INVEST IN ADVERTISING, INNOVATION AND/OR A PRIVATE LABEL

So, what’s a good strategy to follow in times of crisis? Do what others aren’t doing! Something Stephan Knaeble also mentions in his recent blog, is that brands who succeeded in prior crisis periods, spend their marketing expenses counter-cyclically. Engage in proactive marketing and see the crisis as an opportunity (Steenkamp & Fang, 2011). Why is this wise to do? In marketing literature we find that during recessions, consumers are more sensitive to price (van Heerde et al., 2013) and pay more attention to the value they are getting for their money (Ou et al., 2014). This means that you shouldn’t increase your prices during a recession, but lower them, whilst still looking after margins. Does this mean all companies should lower prices, with possible price wars as a result? No. Thankfully, there are a few other options.

Advertising can be used to build a strong brand for the long term (advertising as a means of brand building). A brand will become more important to people during a recession (Ou et al., 2014). Advertising can also help make consumers less price sensitive (van Heerde et al., 2013). Although effects of advertising are stronger in positive economic times then in recessions, advertising ensures a strong brand effect. Research also shows that companies who advertise counter-cyclical, so advertise during recessions, achieve better financial results (Tellis, 2009) as Knaeble already mentioned. And because a lot of companies will limit advertising expenditure, you can stand out more as a company, simply because there is less advertising.

Although most companies might have less cash flow, recessions are good periods to invest in innovation. Because there is less demand, and therefore less production, this capacity can be used for innovation. The risk when less money is being invested in innovation, is that companies lose their technological advantage (Srinivasan et al., 2011). Investing in innovation during recessions leads to a higher market share and profit (Steenkamp & Fang, 2011). A recession isn’t necessarily a period to be launching new products, because consumers are uncertain and spend less money. The effects of innovation are greater than those of advertising, especially in the long term (Steenkamp & Fang, 2011). So, if you have to choose what to invest in, innovation is the better option.

In some industries, companies have the possibility to introduce a private label. During a recession, private labels become more popular, an effect that is noticeable even after a recession (Lamey et al., 2007; Lamey et al. 2012).

Direction

It is inevitable that we will enter a worldwide recession. It remains to be seen how big this recession will be, although the Dutch population expects the corona measures to continue for about 6 months. We can learn several things from marketing literature that can help companies get through the crisis. The most important lesson is to carefully follow in which direction the behaviour is changing and to respond to it in an anti-cyclical manner.