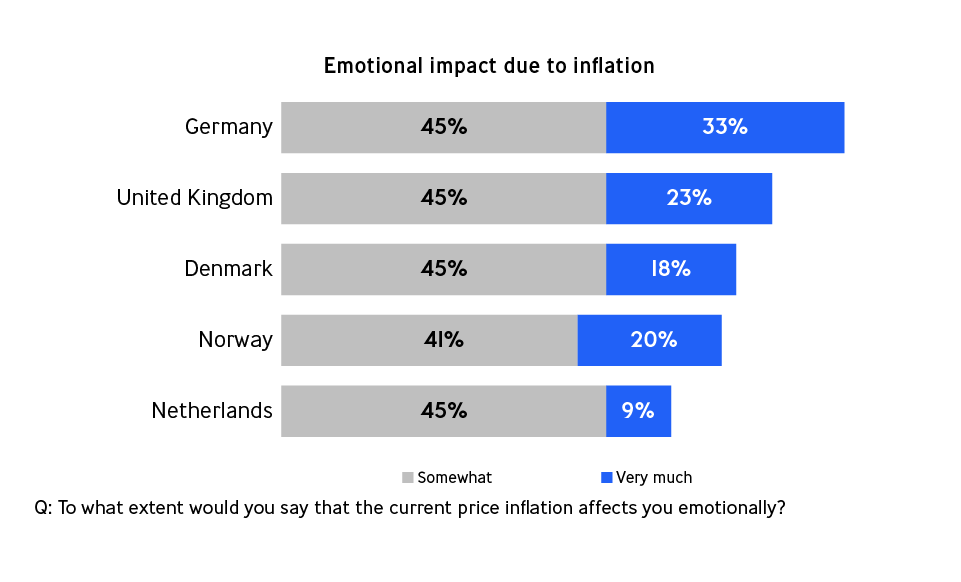

EMOTIONAL IMPACT STRONGLY DIFFERS

That inflation impacts consumers is obvious, but we discovered different emotional reactions based on our study among 1,250 people in the Netherlands, Germany, the UK, Denmark, and Norway. The UK and Germany feel the most emotional of all countries. 33% of people in Germany are very much affected by price inflation, compared to 23% in the UK. The inflation affects the Dutch, Danish, and Norwegian people less. Emotions that are felt most often are anger, worry, and fear. The Nordics are almost neutral concerning inflation, which is in line with lower expressed financial impact.

CONSIDERABLE CHANGES TO DAY-TO-DAY AND FINANCES

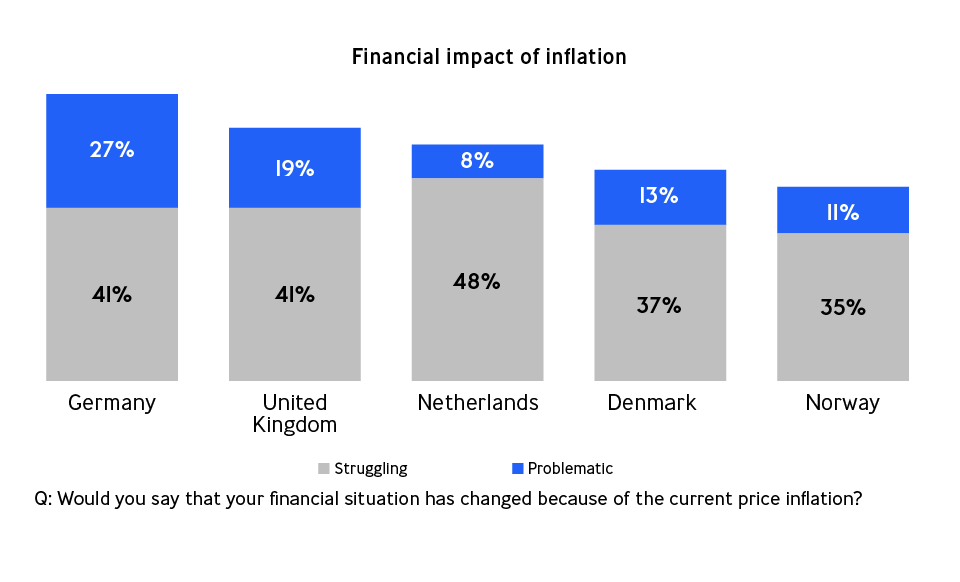

The registered inflation rates don’t lie: UK inflation spiked to a 30-year-high of 9.1% at the end of June. On the mainland, inflation affects the Dutch economy (8.8%) more than the German one (7.9%). Germans and people living in the UK feel the most impact on their daily life and financial situation due to the price inflation: 39% of Germans say that the situation has a big impact on their day-to-day, compared to 37% in the UK, and 19% in the Netherlands.

The Dutch feel more impacted on a financial level: 48% struggle with their financial situation, compared to 41% in both Germany and the UK. Germany scores the highest on financial impact: 27% find their financial situation as far as problematic. Norway shows the lowest engagement with the current inflation, which is in line with their inflation rate of 5.7%, making them one of the least impacted countries in Europe.

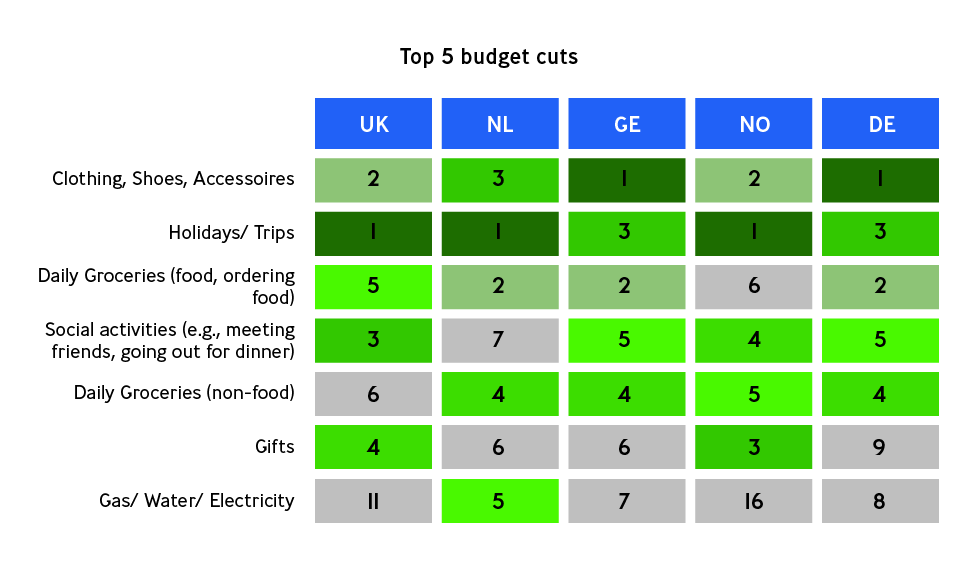

HOLIDAYS AND CLOTHES MAKE WAY

The study shows 6 different reactions to the inflation crisis. While some save on frequently bought categories or opt for cutting down on leisure activities, others are emotionally and socially affected or even cut on necessities.

Dutch people are more pragmatic, saving on the most frequently bought categories like groceries, clothes, and holidays. While people in the UK and Norway appear to be more ‘fun savers’, cutting budgets on leisure, holidays, and social activities. Germans notice a big impact on both their financial situation and mental health, which makes them actively save in the broadest sense, including clothing and groceries. Holidays come in third as a way to keep money in their pockets.

Looking for insights into your category and brand?

Interested in specific insights in categories (e.g. daily groceries, personal electronic devices, household appliances, home improvements, cosmetics, insurance), and/ or in a follow-up study including your brand(s), competitors and/or categories? Check the box ‘Yes, I am also interested to learn more about a custom-made follow-up study’ in the download form below, and we will get in touch as soon as possible.

Download the report

Get ready for more insights into the emotional impact per country, budget cuts, and how people are coping with the inflation in terms of (cheaper) alternatives, use of promotions, and attention towards advertising.

Fill in your details below to download the report.

Required field*

RESEARCH METHOD DVJ INSIGHTS

The study is conducted among 1,250 people 18+ years old in Germany, the Netherlands, the United Kingdom, Denmark, and Norway. This number is the national representative. In addition, a representative sample by gender and age was used. Based on this sampling method, we can state that the results represent the opinion of these five countries as it was at the time of measurement.