How did COVID-19 change innovation acceptance?

Gepubliceerd op 13 11 2023STUDY COMPARING INNOVATIONS DURING & POST COVID-19

Charlotte von Kries

This paper examines the performance of early COVID-19 innovations three years later. Since the global pandemic lastingly altered our lives, we wanted to see what effect these changes had on consumers’ responses to previously tested innovations.

We selected a subset of still-applicable COVID-19 innovations that we already tested in 2020, and re-assessed their performance in 2023 through a condensed version of DVJ’s validated concept test. Comparing the level of acceptance and the scores for a set of evaluation statements, supported by open ends, we saw a split result. On the one hand, technological advances in combination with changes in people’s lifestyles made a streaming concept, VR house viewing, small office units delivered to your doorstep and an indoor movement app more fitting to consumer’s lives. On the other hand, there were concepts such as the Shop Safe App and an anti-virus scarf for which there is less of a need now which resulted in lower acceptance, less relevance and a worse fit to the current situation.

All in all, this study strengthens the importance of being aware of the climate in which an innovation is to be released as well as testing it under these circumstances and not just transferring earlier results to a different period.

After the summer of 2023 had been filled with festivals and travelling again, COVID-19 and its subsequent massive changes feel like a distant memory. While some aspects of our lives returned to a pre-COVID-19 state, other aspects have been lastingly altered. Video calls are an essential part of most jobs now, takeout food is still popular more than before and many people go through life with the pet they got during the pandemic.

How the market suddenly changed

But let’s take a look back to March and April 2020. Right after the global pandemic was declared, DVJ Insights performed a concept test of 90 concepts in the UK, the Netherlands and Germany to understand how COVID-19 was impacting the climate for innovation. This study showed that previously successful innovations no longer have guaranteed success. While innovation remained an important driver for growth, it needed to respond to the new circumstances caused by the global pandemic and offer a clear solution for the friction the innovation was responding to. Successful concepts in this test specifically differentiated themselves from other concepts through a good insight with strong friction.

In the 2020 study, the concept that had the highest accepter score was a beer brand producing disinfectant hand gel in both the Netherlands and Germany. For the UK, the concept of a car brand helping to develop a new breathing aid was most accepted. These two concepts showcase features that academic literature also identified as important characteristics of innovation during the pandemic.

A beer brand starting to make disinfectant hand gel from residual alcohol and a car brand developing breathing aids showcase two need-based innovations born from quickly adapting the existing manufacturing systems to meet a sudden need in medical supplies. While the crisis led to sudden excess capacity in certain industries, the winners of the crisis decided to adapt their manufacturing systems quickly or initiated previously unexpected partnerships and, thus, used their excess capacity to help overcome the crisis (see Brem et al. (2021) for a more detailed perspective). Certain industries thereby became part of “a restructuring of capacity [that] last occurred during World War II, but what happened in months or years then now happen[ed] in hours due to today’s communication structures” (Brem et al., 2021).

So, on the one hand, a new environment suddenly emerged from which numerous innovations quickly arose and on the other hand consumers were put into a very different situation in which they had to make choices. While initially there was an expectation to return back to a pre-pandemic state at some point, We now know that after the pandemic ended, we shifted to a “new normal.” Under these new circumstances, we were curious which of the previously tested concepts would now, more than three years later, (still) be highly accepted and which concepts less so. That is why we perform a re-test of those concepts that we tested right at the beginning of the pandemic.

Testing COVID-19 innovations once again

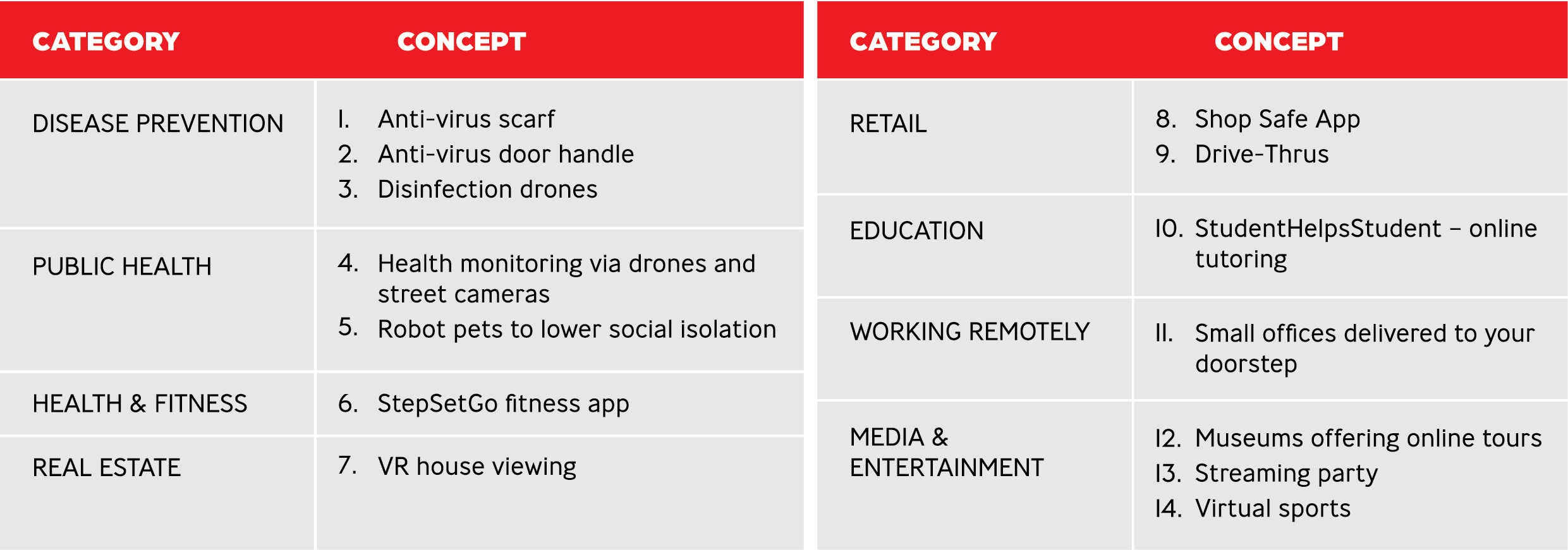

We, therefore, set up the same concept test as in the spring of 2020 to re-test the concepts. We decided to use a subset of the innovation concepts from 2020, namely those concepts that still sounded fitting three years later. The tested concepts are shown in Table 1.

Table 1: Overview of tested categories and concepts

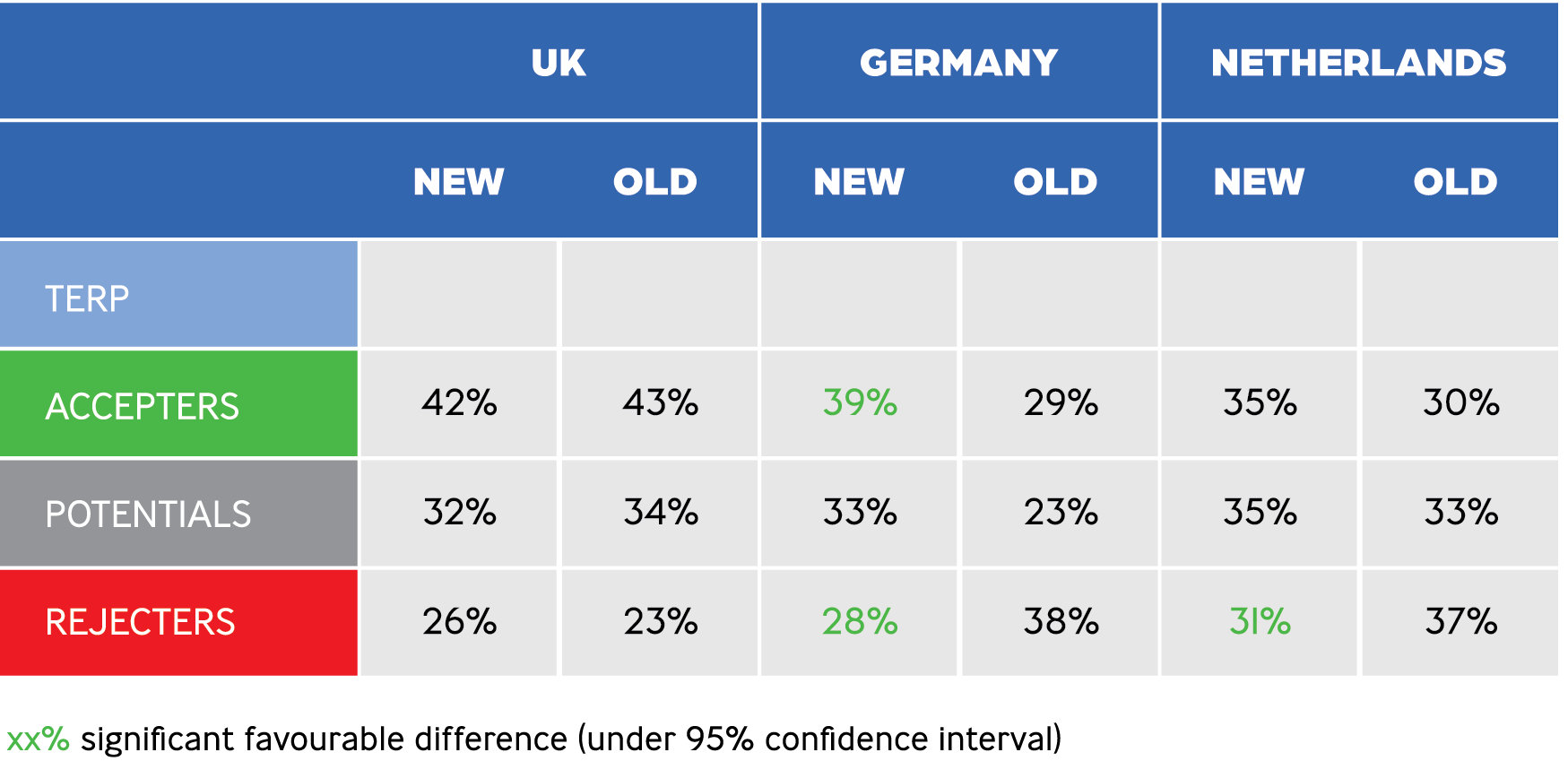

Again, we used a filtered version of DVJ’s validated test design to measure the strength of innovations. Hereby, we focused on the Total Emotional Response Profile (TERP). TERP is a validated method to measure the in-market potential of a concept. This technique is based on six questions that determine the interest and acceptance levels of a new concept. Based on the scores on those six questions, participants are assigned to one of three following groups:

- Accepters: The % of respondents that have an interest in the concept and accept the concept

- Potentials: The % of respondents who have an interest in the concept but do not yet accept the concept

- Rejecters: The % of respondents that have no interest in the concept and do not accept the concept

Just like before, the questionnaire was further enriched with a couple of evaluation statements to understand how to potentially improve the concepts and to shed light on the strengths of winning concepts. The resulting online survey was then answered by ~ 500 participants from the UK, Germany and the Netherlands each at the end of July 2023. Each participant was presented with three concepts that were randomly allocated. All concepts were presented through an insight. Three concepts also included a picture of the concept as the same had been done in the 2020 survey.

How are the concepts now perceived?

As a first start of diving into the results, we compared the TERP scores from the previous with the current measurement. When we compare the new and old data, we can see that Germany and the Netherlands have higher accepter scores and at the same time lowered rejecter scores on average. In the UK, on average TERP scores remained similar to the scores from the previous measurement.

Table 2: 2023 and 2020 average TERP scores per country

Next to this more general comparison, we wanted to take a look at the individual concepts and see which concepts are more or less accepted in 2023 compared to 2020.

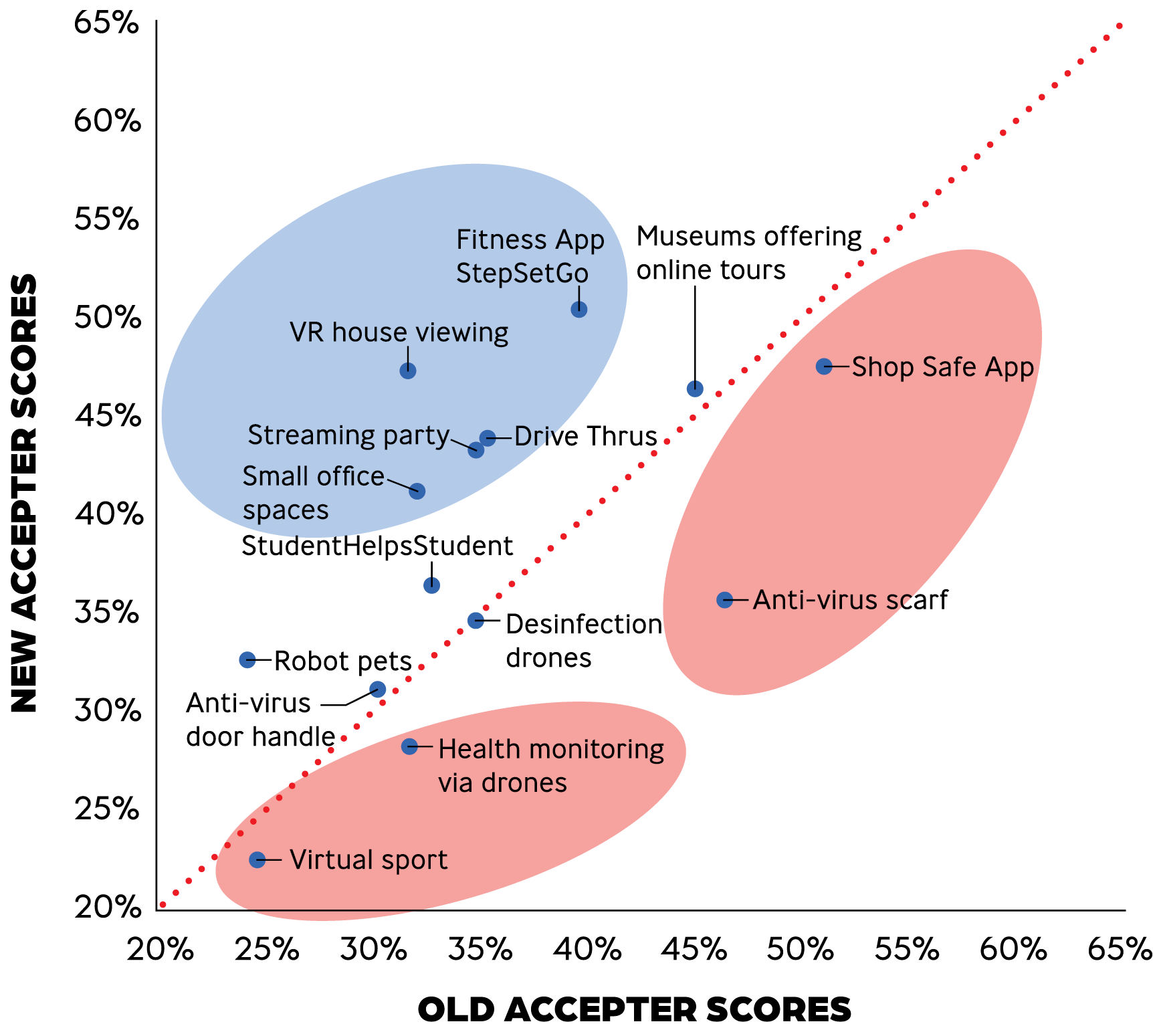

Figure 1: Old accepter scores and new accepter scores per concept

(averaged across the three countries)

The scatter plot (Figure 1) shows the relationship between the old accepter scores (x-axis) and the new accepter scores (y-axis) for the individual concepts. The dotted line is a visual representation of the threshold above which a concept was more accepted and below which concepts got less accepted this time than before. This graphic representation illustrates a pattern of those concepts that got more accepted and those that got less accepted post-COVID-19.

The innovations in the red area were more accepted under the circumstances of the pandemic. Now, that there is less of a need for them, they also get less accepted. On the contrary, there are concepts in the blue area that consumers accept even more in 2023. Probably since they fit their life, needs and interests due to developments induced by the pandemic even better now than back in the spring of 2020.

At the beginning of the pandemic, when the first measurements took place, concepts that helped get through the altered life circumstances such as the lockdown and which helped perform social distancing were appreciated. Therefore, concepts such as the Shop Safe App and the anti-virus scarf were more accepted back then. Now, those concepts are no longer necessary. Interestingly, for innovations like the anti-virus scarf consumers have in the meantime been primed to a certain product, i.e. medical face masks, which they now consider as an already existing effective solution to the original friction. As a participant phrases it: “FFP2 masks have been proven to be effective. This scarf seems like nonsense to me. There is a reason why FFP2 masks are single-use items!”

The pandemic accelerated the pace of change. As Brem et al. (2021) phrase it: “Organizations [were] also forced to contemplate solutions they have been previously reluctant to adopt, in order to reduce the spread of the virus.” That’s how digital transformation occurred at an enormous pace and as a consequence, hybrid working is still common and for many companies even the norm post-pandemic. Post-pandemic, technical solutions have become common to perform activities such as business meetings or seeing friends remotely. This development is reflected in the much higher scores for the VR house viewing concept and the streaming party concept. The streaming party concept is seen as a means to “cut down on loneliness and isolation” and “a chance for family time and interaction”. The pandemic made us learn the hard way that people can still be connected even if they live apart and ways to bridge that physical distance are now seen as a real alternative. For the VR house viewing concept, the open ends show that it is especially seen as a helpful tool for getting a proper first impression of an object but also that it wouldn’t necessarily replace a traditional viewing at a later stage.

As part of the new working reality post-pandemic, we got more familiar with the challenges of working and living in one location. This familiarity can be seen in the open ends for the small office spaces concept for working remotely which is perceived as “a space away from your living area to focus.” Also, the Fitness App StepSetGo which helps to regularly move while working from home is much more accepted now. Consumers see it as a response to a new work-life reality, i.e. “a good way to help people take a break away from their desks” and “a good way to combat increasingly sedentary lifestyles.” Further, there seems to be more awareness about the effects of exercise on mental health.

What can we learn from the Evaluation statements?

First, we looked at the average TERPs per country, then we focused on the acceptance winners of the re-test. Enriched with the open-ended answers, we got more details about why that moved the needle for the consumers. To leverage the full potential of our condensed version of DVJ’s validated concept test, we also analysed the evaluation statements. These statements help in further understanding the strengths of the winners. Here, we can see that the acceptance winners show top 20 scores in relevance, credibility, willingness to share, fit to the current situation and good addition to the existing offerings.

This further indicates that those innovations are indeed fitting to people’s lives now; they are seen as relevant and credible. Compared to 2020, the winners show on average 17% higher scores for credibility which could signify that the digital transformation during the pandemic made it easier to envision the actual implementation of these concepts which did not seem feasible before.

The losers especially stand out with bottom-20 scores for fit to the current situation and willingness to share. These innovations do not fit people’s lives and the current situation anymore, and thus people are unlikely to share those. Compared to the previous year’s scores these concepts score 20-30% lower in fit to the current situation and 10-20% in relevance which underlines once more that there is less of a need for them.

Conclusions and implications

In this study, we re-tested COVID-19 innovations that we also tested back in the spring of 2020. Interestingly, we do see changes in how likely people accept these innovations. Some are considered less relevant and not fitting to the current situation anymore. These concepts are thus less accepted now than back in 2020. Other concepts however fit people’s lives even better now compared to the beginning of the pandemic. Those concepts are considered more relevant and credible and consequently also reach a higher degree of acceptance.

Innovation is known to be one of the strategic responses to crises (see Wenzel, Stanske & Lieberman (2020) for examples from other crises). On the company side “crises trigger a mode of reflection that allows managers and employees to transcend the boundaries of what they believe is thinkable and feasible” (Wenzel et al., 2020). For consumers, it changed the way they reacted to innovations as they were more willing to contemplate certain innovations than they would have under other circumstances (see Brem et al., 2021).

While crises such as a worldwide pandemic exacerbate such processes, this can also happen through other types of events and developments. Smaller and bigger changes can make products that fit people’s lives less relevant, credible or fitting afterwards.

The insight and product concept must fit the circumstances and the resulting needs of that particular time. To ensure this, it is vital to consider the general climate of the period in which you want to release innovation and not simply transfer the results of your concept test from previous years to the current but to test at the relevant moment in time.

References

Brem, A., Viardot, E., & Nylund, P. A. (2021). Implications of the coronavirus (COVID-19) outbreak for innovation: Which technologies will improve our lives? Technological forecasting and social change, 163, 120451.

Wenzel, M., Stanske, S., & Lieberman, M. B. (2020). Strategic responses to crisis. Strategic Management Journal, 41(7/18), 3161.