Conquering the land of CEP’s

Published on 05 12 2018Blog Roderik Sorbi – Senior Consultant

Maybe you’re at the train station and you’re too hungry to wait for dinner at home, so you eat a candy-bar. Or you’re enjoying a cup of coffee in the late afternoon, and want a complimentary snack, so you eat a candy-bar. There are lots of buying motivations for buying products. These are called category entry points. CEP’s are associations linked to a specific moment or situation. The more your brand relates to entry points and is actively present in your consumers mind, the bigger your mental share is and the more your products are being purchased.

Every brand has some level of unaided brand awareness. If you know to what degree you’re associated within a category entry point, you know your mental share. Byron Sharp refers to it as salience. This goes beyond the ‘general’ unaided brand awareness. It involves how strong the memory structures of a brand (which includes active awareness) are instantly connected with the key buying motivations of a category. And it involves learning your mental share.

What are the struggles brands come across?

In light of our Ingredients for Brand Growth platform, we hold various expert interviews with CMO’s across industries. Something I notice often in these interviews: knowing your mental share is important. So, why is it so difficult to put this into practise? A struggle I come across often with brands is that they have a high level of brand awareness in some countries, but they’re not growing. Relevance is key here. Some brands have become their category in a way.

Let’s get back to the candy-bars. In the confectionary industry, you have lots of different CEP’s. You have chocolate for sharing, for giving, for indulgencing and to satisfy your appetite instantly. And it’s the same for many other products. The one thing is though, the brand needs to be linked to one of those associations in the mind of the consumer. Certain drinks for instance, may not reach further than one CEP. They might be great for thirst quenching, but they’re not associated with social occasions in the mental network of the consumer. And for some buying motivations a single product proposition is not enough. Here one might need to create a different type of drink and/or another packaging to be much better be associated with social occasions in the consumers mind. With instances like this, product innovation is needed in order to conquer a different CEP. As a result, CEP’s are a holistic growth framework driven by brand and innovation. It offers marketers more focus when it comes to their strategy.

Should you focus on all entry points, then?

Imagine if a category has 8 different and most important entry points. Your brand has a mental share of 5% in the first CEP and another CEP has a mental share of 15%. Which one do you need to prioritise for instance? First, we look at the individual CEP’s. Has a CEP already been claimed by another brand? If so, you can’t win from brands who have imbedded themselves to a specific motive in the minds of the consumer.

So, CEP’s are more than just measuring salience and mental share. It’s a framework to help you grow your brand in the most effective way. It can help you determine which CEP’s to focus on in a category, and what is needed for each CEP not only in terms of mental availability, but also related to physical availability, including innovation prioritisation of which CEP’s are best left behind.

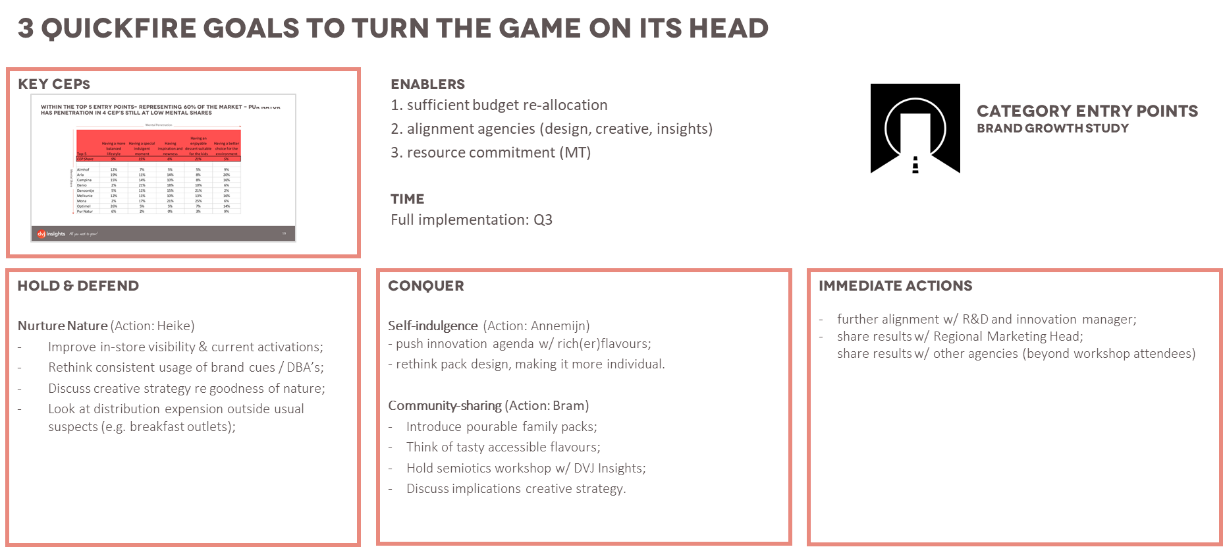

The challenge for marketers lies with where and how they can grow the fastest. How they can conquer every CEP, own and defend each CEP. In particular the one that allows them to penetrate and grow, at the cost of their main competition.

The most important question is: How do you find your CEP’s?

CEP’s are difficult to detect in research. You always work with pre-programmed lists the brain doesn’t understand that well. You want to make a direct link to the mind of the consumer, but you don’t want to drown in the amount of data. Well, we have the answer.

It’s storytelling, but linked to brand associations around the stories. We not only dive in to the mind of the consumer, but we give the respondents the opportunity to link their stories to a brand and a situation afterwards. With this, you get insight in relevance and brand positioning.

So, I’m proud that our storytelling gives people an unbiased insight in to all the motives to buy a brand. On the basis of DVJ’s story markers – elaborating questions – we can identify the size of these CEP’s. We ask people whether the purchase can be specifically linked to a certain entry point. ‘If you think about these points, what brand do you think of?’ At DVJ we translate what impact the results have for your brand activation and innovation. It helps you determine which CEP’s to focus on in a category. And now you know which CEP’s to focus on, it’s time to translate those moments to activation. This is where communication, CEP and innovation come together. That is why DVJ organises activation workshops with clients with whom we conduct such a Brand Growth Framework study.

In conclusion, CEP is a brand growth framework. It’s more than brand awareness alone. It helps you make conscious decisions and bring focus to your brand strategy and activation. Making choices, looking more consistently at innovation and seeing how brand penetration and mental share develop. It’s about conquering lands. Winning over a different CEP each time. Forming a strong front by connecting brand growth, communication, product- and packaging. Ensuring that the brand is strongly connected to that buying moment of quenching my thirst, after running up the stairs of the train station. When I arrived just in time, to catch the last carriage home.