Client’s Challenge

Our client, a global manufacturer in FMCG, sets annual ambitious growth goals for its candy/snacks portfolio. They envisioned opportunity by understanding when, how, how often, and why their category is consumed. They wanted to connect Category Entry Points (CEPs) with their brands mental market share. Our client sought to craft their brands, communications and portfolio, to have products and messages for the right occasions. However, lacking previous research, they were not certain which CEPs were most relevant. They were also unsure how their brands and competitors performed on CEPs. Lastly, they were interested in how the CEPs-brand relationship would evolve over time as they run their campaigns.

The Approach

DVJ developed an approach based on the academic work of Jenni Romaniuk from the Ehrenberg-Bass Institute. She provided a sophisticated and empirically proven model to measure mental market shares. In fact, she shows that CEPs are the building blocks of Mental Availability — they capture the thoughts that category buyers have as they transition into making a category purchase. Strong Mental Availability, being easily thought of in buying situations, is essential for building a successful brand. Without it, and the necessary physical availability, a brand can’t grow.

Figure 1: According to Ehrenberg-Bass, brands growth depends on mental and physical availability. CEPs and distinctive assets combined ensure mental availability.

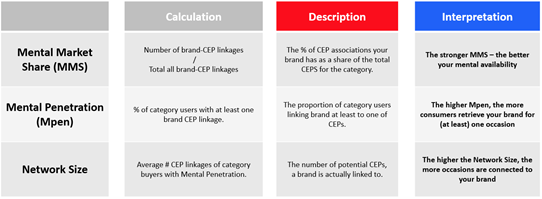

DVJ built a long list of CEPs with the client. This list was cut to the 15 most common, and online surveyed on relevance among a representative group of consumers. Furthermore, to make the CEP-brand connection, consumers were also asked: “Which brands do you think of when you think of the following occasions?”. For precise results, DVJ made sure to ask this question for all brands available in the market. Based on consumer responses, three valuable underlying KPIs could be calculated: Mental Market share, Mental Penetration and Network Size.

Figure 2: Description of relevant underlying KPIs

The Results

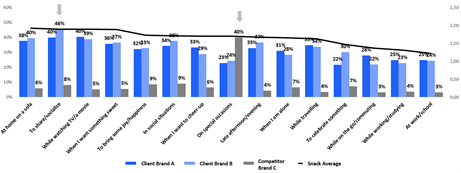

For our client, clear graphs, dashboards and actionable insights were provided to grow their brands. An analysis was produced matching relative importance of CEPs and brand performance, showing where the client’s brands (or competitors) were under or over performing compared to the important occasions. To grow the brand, the client wants to aim for overperformance, especially on the most important occasions. Furthermore, looking at the variety of occasions and brands, our client could strategise its portfolio matching and extension.

Figure 3: Example analysis, matching average per CEP and brand performance

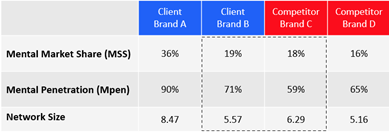

Underlying variables Mental Penetration and Network Size also provided tangible insight. For instance, Client Brand B has a comparable mental market share to Competitor Brand C, but the underlying metrics differ. Brand B is linked to at least one CEP by relative more consumers, but not to as many different CEPs (Network Size) as Competitor Brand C.

So, what can we learn from this? On the one hand, to increase its mental market share, Brand B is advised to find ways to increase its variety of occasions to grow the network size. For competitor Brand C the challenge differs, it would have to drive penetration amongst consumer that currently don’t link it to any CEP in order to grow Mental Market Share.

Figure 4: Example of valuable analysis by means of underlying KPIs

Client’s Benefits

The actionable insights of CEPs and Mental Availability in relationship to brands, helped our client at a global and local level to shape its brands and media strategy. It provided input for decisions around which occasions to target, brand communication, positioning, portfolio management and competitive analysis. Furthermore, being active in a dynamic FMCG market, the client will also benefit from quarterly monitoring of MMS and underlying KPIs, validating the effectiveness of their decisions.

Lastly, whilst testing this new KPI, an additional DVJ analysis across all countries and categories showed there is a significant and positive correlation between MMS and the brand funnel (i.e. advertisement awareness, instant appeal, consideration and preference). This underlines that research investment into knowing your CEPS, MMS-brand linkage is a valid methodology for brand growth.